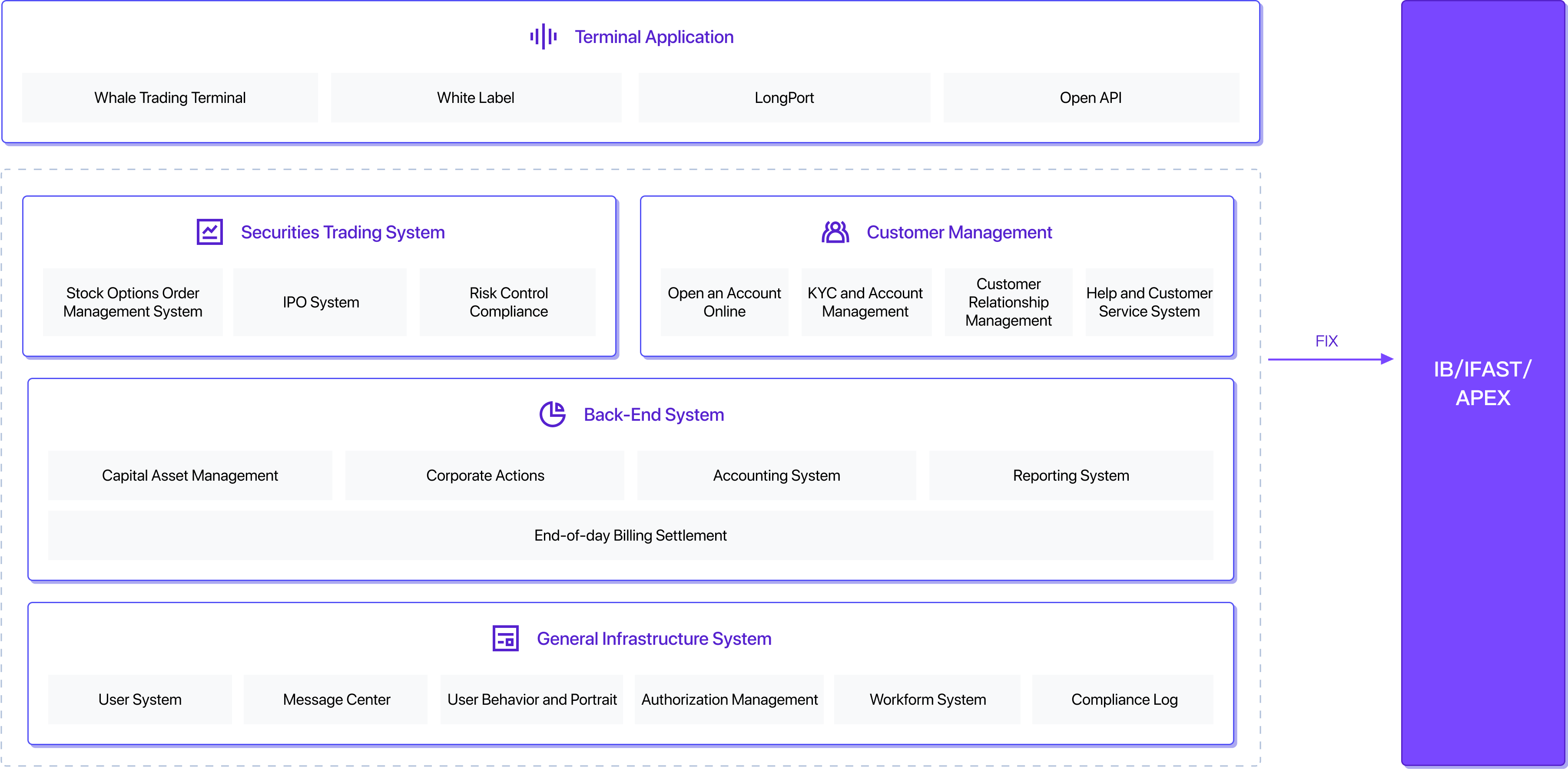

Whale One-Stop US Stock & Option Solution

Fast implementation, low cost, and powerful US stock trading capabilities

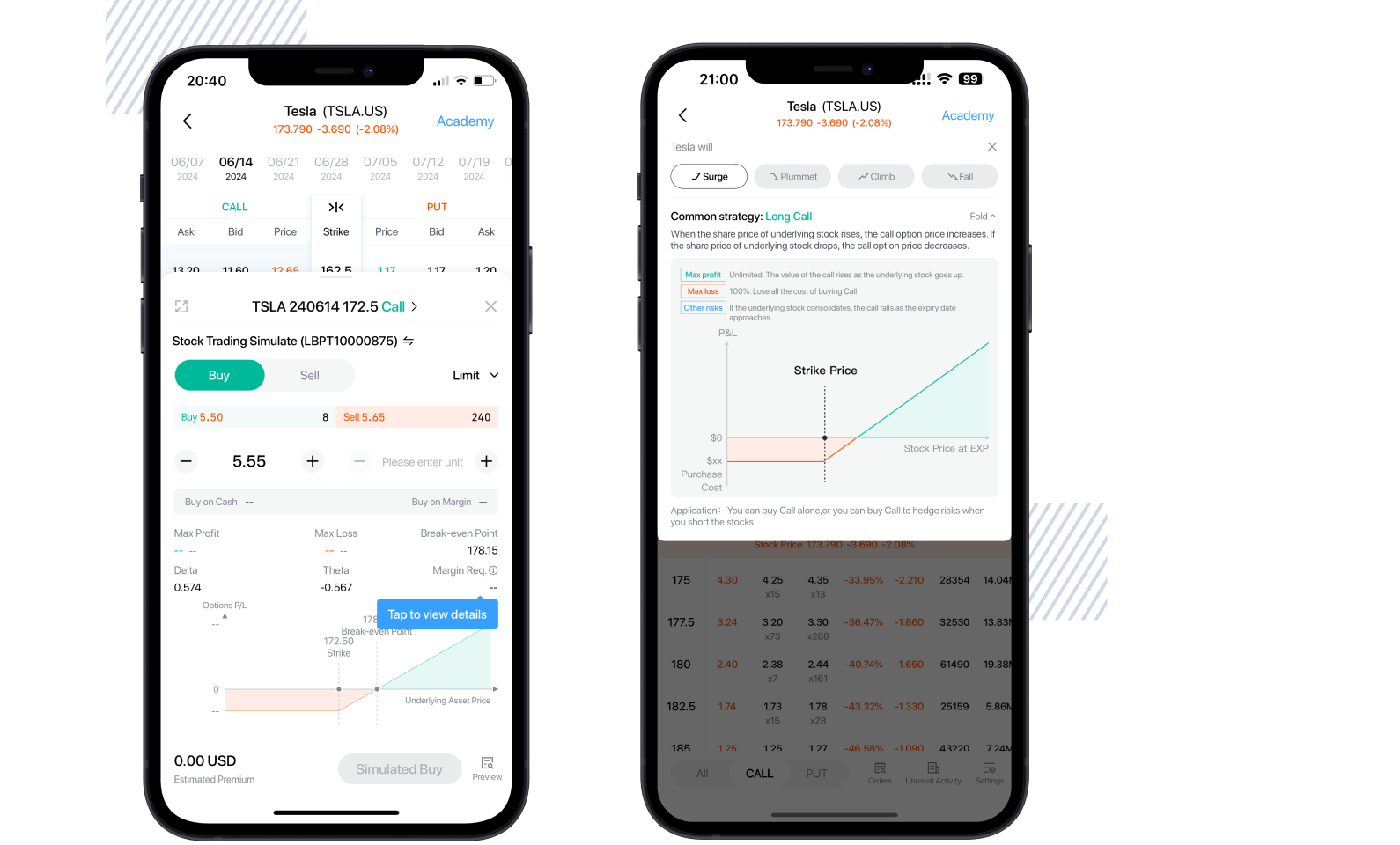

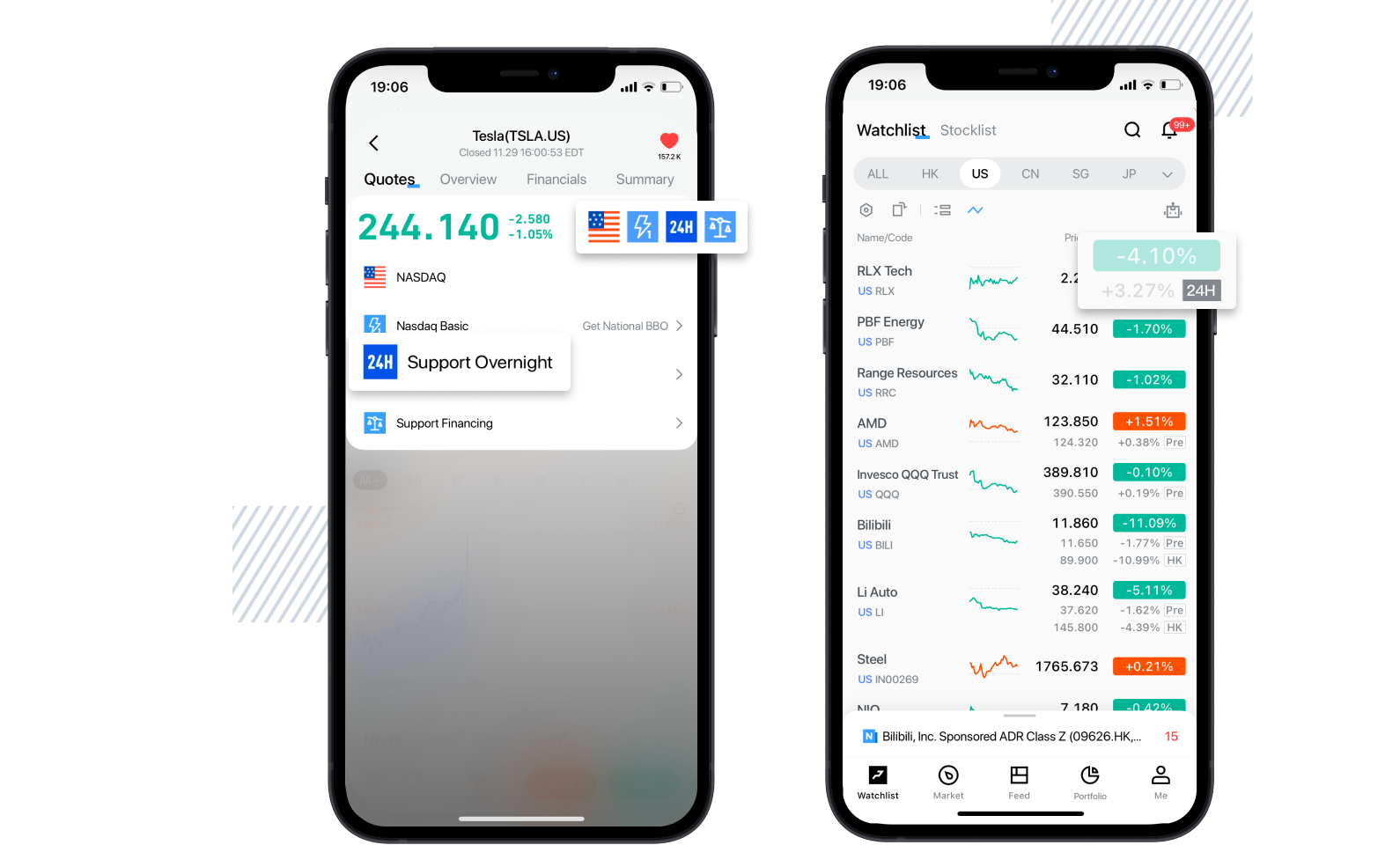

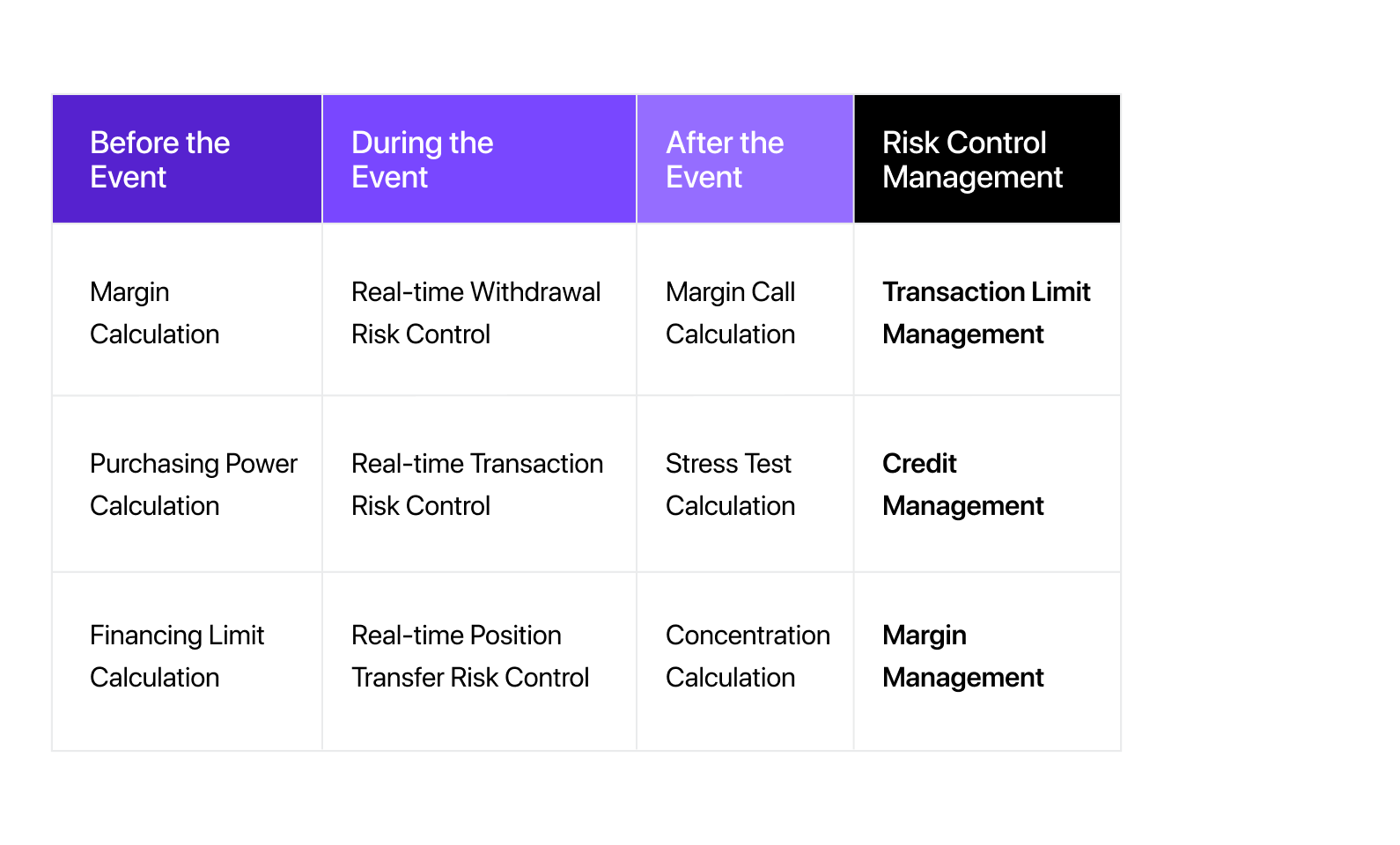

Whale provides a one-stop solution for US stocks and options trading, supporting trading in US stocks, margin trading in US stocks, and options trading. It covers various business scenarios such as real-time market data, trading, risk control, deposit and withdrawal. It helps clients quickly establish their presence in the industry, with low costs and minimal manpower, while gaining powerful US stock trading capabilities.